JOin our cash buyers & investors network

Be the first to receive alerts and updates on exclusive residential and commercial opportunities.

Investment areas that we consider:

1. Transactional Funding: We offer transactional funding loans empowering wholesalers to close more deals with higher profits. Visit www.cashdoubleclosing.com to learn about this offering and to submit new deals. Our fees start at 1%+ and we fast to process your deals. For any questions, please feel free to reach out to the Transactional Funding team at doubleclosing@tulsarealestatefund.com.

2. Co-GP Syndications: We co-general partner with emerging minority sponsors on joint venture syndications. We focus on opportunities that require $200,000 – $1,000,000 of equity. As of Q3 2020, we are more prone to partner around the following types of deals:

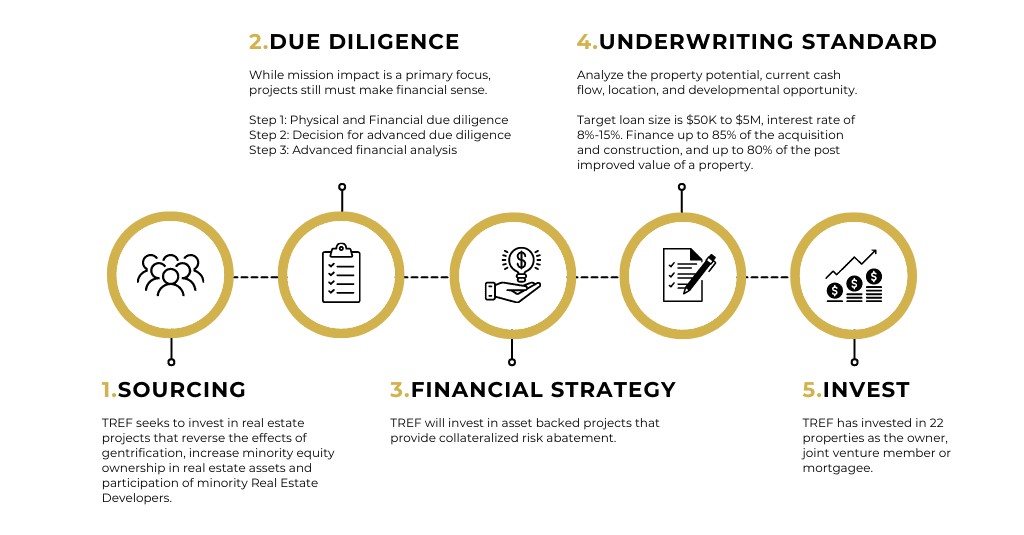

3. TREF Private Lending: We broker bridge and conventional loans via our network of private lending partners. This is a service based business with minimal upfront investment. We leverage this offering to extend and maximize our real estate activities. As of Q3 2020, we are more prone to partner around the following types of deals:

Join to receive alerts and updates on exclusive investment opportunities and a chance to get on the waiting list for TREF Fund II.

Be the first to receive alerts and updates on exclusive residential and commercial opportunities.

Join for a chance to get on the pledge list for TREF Fund II.

No bank information will be collected at this time. You will receive notification when the next capital raise starts and can complete your capital contribution at that time.

We’re happy to review your opportunity. After you submit, please give us 3-5 days to review and a member of our team will reach out to validate the opportunity. Once terms are agreed upon, it will be underwritten by a 3rd party ($795.00 fee) followed by a swift close.